PREDATORY LAWSUIT LENDING

Third-party litigation financing has flourished in New York City in recent years, generating millions of dollars for finance firms. This industry preys on vulnerable consumers, while making it more difficult to resolve cases for reasonable amounts.

Third-party litigation financing has flourished in New York City in recent years, generating millions of dollars for finance firms. This industry preys on vulnerable consumers, while making it more difficult to resolve cases for reasonable amounts.

These businesses operate like payday lenders, encouraging individuals with lawsuits to take a relatively small “advance” on their expected settlement. Examples abound of consumers taking a small loan ($350 to $1,200) while a run-of- the-mill claim like a slip-and-fall is pending and then being on the hook to pay the lender five or ten times that amount. These amounts are taken from the plaintiff’s settlement, after payment of the personal injury attorney’s contingency fee. When a settlement is reached, a consumer may have little or nothing left. In one instance, a lawsuit lender has reportedly charged New Yorkers interest rates as high as 124%.

In 2017, the state Attorney General and the Consumer Financial Protection Bureau brought a suit against RD Legal Funding for exploiting 9/11 first responders and NFL concussion victims with interest rates up to 250 percent. Although the initial lawsuit was dismissed by Judge Loretta A. Preska in 2018 due to constitutional defects in the CFPB’s single-director leadership structure, the 2020 U.S. Supreme Court ruling in Seila Law v. CFPB fixed the problematic structure and compelled Judge Preska to reverse her decision in 2022. The CFPB and the Attorney General may now proceed with their litigation from 2017, but there have not been any updates.

Other dangers of litigation funding are illustrated by a scam that played out in New York City. In 2021, a federal grand jury indicted five conspirators – two doctors, two personal injury lawyers, and one litigation funder – on mail- and wire-fraud charges. The defendants were caught recruiting vulnerable individuals, also referred to as “patients” by the perpetrators, to stage trip-and-fall accidents in various areas of New York City. After the patient staged an accident, the two attorneys would file personal injury lawsuits on their behalf against businesses and insurers. The two doctors would then instruct patients to undergo unnecessary medical and chiropractic treatments to maximize the value of their claims. Afterwards, the patients received a mere post-surgical stipend of $1,000 to $1,500.

The litigation funder would offer to pay for patients’ medical and legal costs in exchange for up to 50% interest rate on medical loans and up to 100% on personal loans.

The scam, which began in 2013, generated almost $31 million, according to prosecutors. After pleading guilty to wire fraud conspiracy, the litigation funder agreed to forfeit over $650,000, and awaits sentencing. He may be on the hook to pay as much as $3.9 million in restitution and will likely face prison time up to 20 years. The lawyers and doctors involved will soon go to trial.

In an advertisement for advocacy group Consumers for Fair Legal Funding (CFLF), Reverend Kirsten John Foy shared his story on how people may fall victim to predatory lawsuit lending. During an arrest by New York Police Department (NYPD) officers for alleged trespassing, Foy was left with a fractured kneecap and a torn rotator cuff. Foy sued NYPD for monetary damages, but his inability to work and the need to cover medical bills led him to rely on lawsuit lending. Foy ultimately received an approximately $225,000 settlement from NYPD. The amount of money that Foy saw was less than half of the actual settlement – about $75,000 after repaying his two loans.

According to CFLF, there are many like Foy who fall victim to these practices. For that reason, CFLF is pushing lawmakers for greater regulation of the lawsuit lending industry.

Although State Senator Anna Kaplan has proposed two bipartisan bills to rein in these abuses by setting a ceiling on interest rates and tracking litigation funding, the industry’s lobbying power prevents the legislation from moving out of committee. One of the bills, named New York Consumer Litigation Funding Act, aims to limit the litigation funding company’s control over the litigation and require these companies to disclose in exact terms the maximum amount the consumer may have to pay.

In addition to subjecting lawsuit lending to safeguards similar to other consumer loans, New York should ensure that the court and all parties are aware of such arrangements. Transparency can expose predatory lending practices and also ensure that parties are aware that a third party may be influencing the litigation or impeding the ability to reach a settlement. Lawsuit lending can drive up settlement demands (as plaintiffs must consider not only how much of the settlement will go to his or her attorney, but also to the lawsuit lender) and make it more difficult to reasonably resolve cases.

Unlike some jurisdictions, New York does not require litigants to disclose the existence of a litigation funding agreement. Although a funding agreement could potentially be discoverable if it is relevant to the case and not otherwise protected from disclosure, thus far, New York courts presented with the issue have found funding agreements irrelevant and undiscoverable.

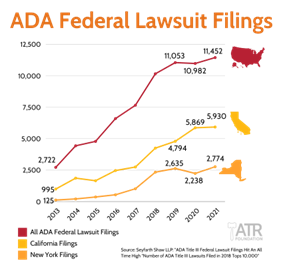

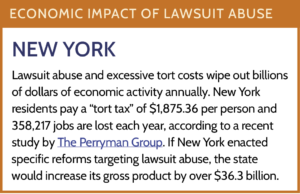

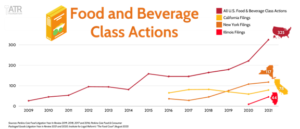

New York’s fall in the rankings is in no way a reflection of positive change in the Empire State, but rather due to the immense challenges facing other jurisdictions. Lawsuit abuse continues to plague New York and bog down the state’s economic growth. Meritless food class actions, American with Disabilities Act lawsuit trolling, third-party litigation financing, and nuclear verdicts only worsened in New York in 2022.

New York’s fall in the rankings is in no way a reflection of positive change in the Empire State, but rather due to the immense challenges facing other jurisdictions. Lawsuit abuse continues to plague New York and bog down the state’s economic growth. Meritless food class actions, American with Disabilities Act lawsuit trolling, third-party litigation financing, and nuclear verdicts only worsened in New York in 2022.

New York State continues to see a surging number of nuclear verdicts, obtained by plaintiffs’ lawyers who use manipulation tactics like “reptile theory” and anchoring to drive up awards using New York’s generous liability laws.

New York State continues to see a surging number of nuclear verdicts, obtained by plaintiffs’ lawyers who use manipulation tactics like “reptile theory” and anchoring to drive up awards using New York’s generous liability laws.

Third-party litigation financing has flourished in New York City in recent years, generating millions of dollars for finance firms. This industry preys on vulnerable consumers, while making it more difficult to resolve cases for reasonable amounts.

Third-party litigation financing has flourished in New York City in recent years, generating millions of dollars for finance firms. This industry preys on vulnerable consumers, while making it more difficult to resolve cases for reasonable amounts.